Contents

View current home loan rates and refinance rates for 30-year fixed, 15-year fixed and more. Compare rates to find the right mortgage to fit your goals.

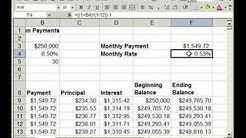

30 Year Fixed Rate Mortgage Amortization Example. The 30 year fixed rate mortgage tends to be the most popular type of home loan because it offers monthly payments that are predictable since the interest rate stays the same over the life of loan and more manageable since they are amortized over 30 years.

30-year rates can be compared to the following popular products: 15-year Fixed Rates – 15-year fixed rates are normally lower than a 30-year and, depending on the lender, the interest rate variance ranges from 0.50% to 0.75%. These rates are often lower because having a shorter term provides significantly less risk to the lender.

Mortgage Rate Update. As of August 28, 2019, mortgage rates for 30-year fixed mortgages fell over the past week, with the rate borrowers were quoted on Zillow at 3.72%, down six basis points from August 21.

What is an amortization schedule? An amortization schedule displays the payments required for paying off a loan or mortgage. Each payment is separated into the amount that goes towards interest with the rest being used to pay down the remaining balance.

What is an amortization schedule? An amortization schedule displays the payments required for paying off a loan or mortgage. Each payment is separated into the amount that goes towards interest with the rest being used to pay down the remaining balance.

The 30-year fixed-rate mortgage averaged 3.75% in the holiday-shortened July 3. The 30-year fixed-rate mortgage averaged 4.81% in the November 21 week. according to the Mortgage Bankers Association. As the chart above shows, they’re now lower than year-ago levels by double.

5-Year Fixed-Rate Historic Tables HTML / Excel Weekly PMMS Survey Opinions, estimates, forecasts and other views contained in this document are those of Freddie Mac’s Economic & Housing Research group, do not necessarily represent the views of Freddie Mac or its management, should not be construed as indicating Freddie Mac’s business prospects.

Here’s the daily interest rate chart (in basis points) of the government’s 30-year bond: 30-year U.S. Treasury bond interest. View and compare urrent (updated today) 30 year fixed mortgage interest rates, home loan rates and other bank interest rates. fixed and ARM, FHA, and VA rates. Current 30 Year Mortgage Rates

30 Year Fixed Mortgage Rate – Historical Chart. interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971. The current 30 year mortgage fixed rate as of August 2019 is 3.55.

Conventional Loan Payment Calculator Conventional loans are typically thought of as requiring 20 percent or more of the purchase price for a down payment. However, for the right borrowers with the right mix of credit, debt and income.Pmi Cost Mortgage Regardless of the value of a home, most mortgage insurance premiums cost between 0.5% and as much as 5% of the original amount of a mortgage loan per year. That means if $150,000 was borrowed and the annual premiums cost 1%, the borrower would have to pay $1,500 each year ($125 per month) to insurance their mortgage.